When to consider a personal loan for home improvement

Remodeling your home is a delightful but expensive affair. Even small, non-invasive home improvement projects like repainting and window replacements can cost you a bundle, and major home improvement projects like kitchen and bathroom remodels will undoubtedly cost you a fortune.

Thankfully, you can obtain a personal loan to pay for the renovation costs without stretching your wallet. In this case, you would get a home improvement loan, which is essentially an unsecured personal loan designed to finance home renovation projects.

When should you choose a home improvement loan over a home equity loan and other financing options? How do you qualify for a home improvement personal loan, and what's the process for getting one?

It's worth a bit of thought, so let's find out how your options compare.

How to determine whether to use a personal loan for home improvement

Given that you most likely don't have the money to pay for your home renovations in cash, and you don't have a 0.00% APR credit card to foot the renovation costs, your best option is to fund your home improvement project using a loan from a lender like a community bank or credit union.

Most likely, you'll have three loan options:

-

Home improvement personal loan

-

Home equity loan

-

Home equity line of credit (HELOC)

HELOCs and home equity loans are secured loans that use your house as collateral. Both loan options require you to tap into your home's equity — the difference between your home's market value and the balance you owe on your mortgage loan. Lenders calculate home equity loan amounts based on the percentage of equity you hold in your home. Typically, the maximum loan amount most lenders allow is equivalent to 80-90% of your home equity value.

That means you may not qualify for a HELOC or home equity loan if you don't have enough home equity, or you may not get the maximum loan amount you need. Moreover, HELOC and home equity loans can be riskier because the lender can repossess your house if you default on your loan payments.

On the other hand, a home improvement loan is an unsecured personal loan, meaning you don't need collateral or home equity to qualify for financing. Banks and credit unions calculate your interest rate based on your credit score, debt-to-income ratio, and credit history. Generally, if you have a good credit score, you can secure higher personal loan amounts with a friendly loan term.

Difference between a home improvement loan and a home equity loan

Unlike a home equity loan, which is a secured personal loan, personal home improvement loans are higher risk because they're unsecured. If you fail to repay your home improvement loan, a personal loan lender may only place a lien on your house, but not seize it. Only in rare and extreme cases can the lender use legal means to foreclose on your home.

While personal home improvement loans carry higher interest rates than home equity loans and have fixed monthly payments over a short repayment period, you get longer repayment periods and lower interest rates with a secured home improvement loan. You can use a personal loan calculator to crunch your numbers and get the actual margin difference.

A home equity loan allows you to borrow higher loan amounts, with the minimum amount ranging up from $25,000. You can borrow as little as $1,000 with a personal loan.

When should you use a personal loan for home improvement?

A home improvement personal loan is best when:

-

You want to limit the risk of losing your house by listing it as collateral.

-

You prefer to avoid high-interest credit card debt.

-

You don't have enough home equity to qualify for a home equity loan.

-

You have committed your home equity for other purposes, such as paying college expenses.

-

You need the home improvement funds urgently.

If you're unsure about your specific scenario or the timeline for you to obtain the loan, it's best to ask rather than guess. A community bank or credit union loan officer can be your best resource to mow through the tall grass before you get too in the weeds.

What you can do with a home improvement personal loan

As the name implies, a home improvement loan is designed to finance a home renovation project. Some lenders may require you to provide a detailed plan of your renovation project before loan approval. A home improvement loan is still a personal loan, meaning the loan terms are not restrictive, and you have the freedom to use your funds as you see fit.

However, given the higher interest rates, you will most likely want to use your home improvement loan on a project that adds value to your home, and only borrow as much as you need. Such projects include:

-

Kitchen, garage, and bathroom remodeling

-

Energy-efficient windows

-

Roof, siding, or floor replacement

-

Solar panel installation or enhancements

-

Swimming pool or water feature installation

-

Repainting

-

Patio cover or deck installation

-

Major landscaping projects

The only limitation is the loan amount. Typically, loan amounts for home improvement personal loans range from $1,000 to $100,000. If you need higher loan amounts for a larger project, you should think about other options like cash-out refinance, a home equity loan, or a HELOC. Consider both your credit and your total costs when deciding which loan is best for your project.

That said, it's worth discussing the pros and cons of home improvement loans.

The benefits of a home improvement loan may be those that help if you are in a crunch for time or looking to save money up front.

-

Expedited loan-processing time: To process your loan, a home improvement loan lender only needs to pull your credit report to ascertain your credit score. After loan approval, you can get your funds in a lump sum within a few days. (HELOCs and home equity loans may take weeks to process.)

-

No collateral or tapping home equity: When receiving an unsecured loan, you don't need to provide collateral or use your home equity to get a home improvement loan. By and large, a good credit score is enough to get you a personal loan.

-

Fixed interest rates and monthly payments: A personal loan is an installment loan with a fixed repayment timeline and rate. This allows you to budget precisely. Also, the interest rates are lower than the credit card interest rate you would pay.

-

Fewer closing and application costs: Although some banks and credit unions may charge an origination fee, you'll pay fewer closing costs as compared to a home equity loan.

Home improvement loans also have some drawbacks to consider, depending on your long-term plans.

-

Home improvement loans charge higher interest rates than HELOCs and home equity loans. Also, some lenders may charge extra fees, such as origination fees.

-

You get no tax benefits.

-

It is difficult to qualify for a personal loan if you have bad credit or your credit utilization ratio is too high. Even if you qualify with poor credit, you'll pay a high annual percentage rate (APR).

-

Loan amounts may not be sufficient to finance a major home improvement project costing above $100,000.

-

It's hard to get an unsecured personal loan as a retirement option because of the loss of income.

There are similarities between personal loans and home equity loans, so your decision on which type of loan is best may depend on factors unique to you and your plans.

-

Both loans are designed to finance home improvement projects.

-

Both loans have a fixed interest rate and monthly payment.

-

Both loans give you the loan amount in one lump sum.

Overall, home improvement personal loans are an excellent option when you have a good credit score, and you're financing small and mid-size renovation projects. It may be better to consider a home equity loan when financing large home renovation projects, and you have a lot of home equity.

How to qualify for a personal loan for home improvement

So far, you know what to do with a home improvement loan, the pros and cons of a personal loan, and how improvement loans compare with home equity loans. At this point, it's only natural to wonder if you qualify for a personal loan for home improvement. Here’s what it takes to qualify for a home improvement personal loan and get the best loan terms and interest rates.

For starters, it's not much different than applying for a personal loan for any purchase: You'll have to prove your identity, address, and income to a lender. You'll need official documents such as your updated bank statements, pay stubs, social security number, and your driver's license.

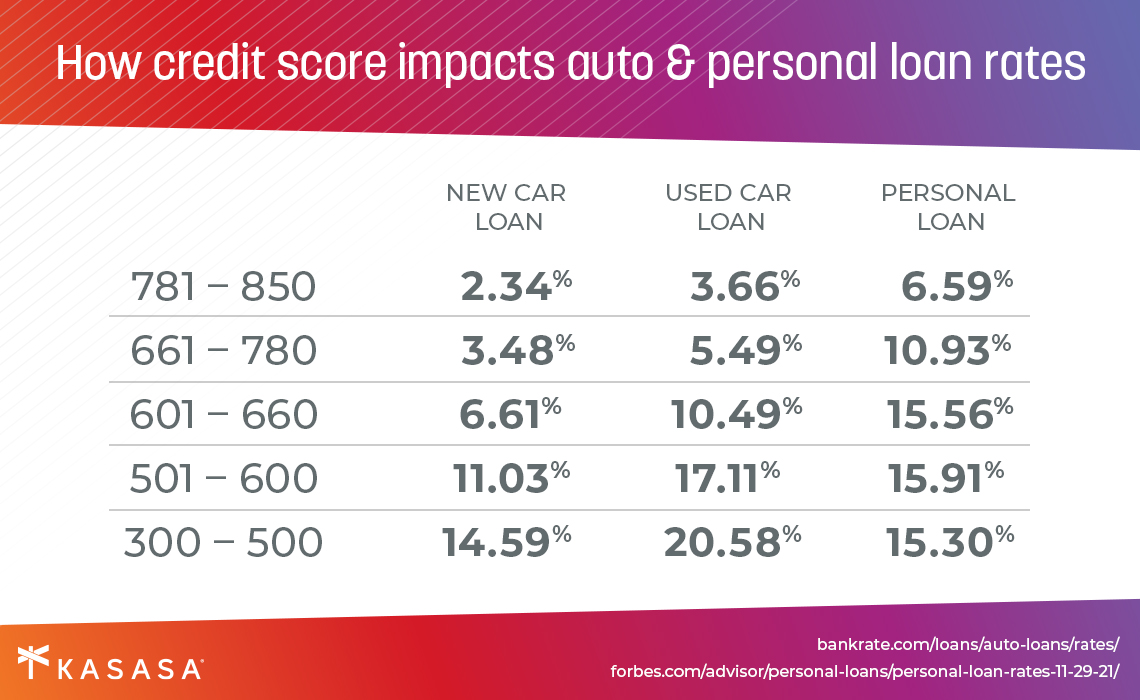

If you have a good or excellent credit score, you'll enjoy faster loan approvals, with a lower APR ranging from about 11.00% to 15.00%. Additionally, lenders will be more willing to lend you higher loan amounts. If you have bad credit, it's unlikely a lender will approve your unsecured loan. In case a credit union or a bank approves your personal loan when you have poor credit, you'll pay a higher APR, typically north of 20.00%, and also get lower loan amounts.

Raising your credit score may seem to take forever, given that financial blunders like late payments and foreclosures stay on your credit report for seven years. Still, it's worth fixing your credit score to qualify for a personal loan, considering the value a home improvement loan adds to your property.

Home improvement can elevate your home's value

The actual returns on your home improvement loan depend on the type of home renovations you're doing. Depending on customer preferences in your local house market, some renovations may command a higher value. For instance, if most house buyers in your area prefer homes with solar panels, a solar panel installation will be more valuable than a swimming pool installation.

However, the benefits of transforming your house into a home might make more sense to you, especially if you're not looking to sell your house soon. If you have a couple of home improvement projects on your to-do list in the New Year, accomplishing the renovations will add sentimental value to your home. You'll make your house cozier and improve your overall quality of life, and since a personal loan will help you fund the home renovation projects that you love, it's worth every penny you pay in interest.

After confirming that you qualify for a home improvement loan, you may consider a few lenders to obtain the loan amount you need. As we'll see below, reviewing several lenders may help you watch out for extra charges such as origination fees and closing costs among your choices.

Process of getting a personal loan for your project

The good news is there are many lending partners ready to offer you a home renovation loan as long as you qualify. With a good credit score, it's easy to shop around for a lender who will offer you an unsecured home improvement loan with agreeable loan terms.

The real work is picking a suitable lender of the many you find. It's a smart idea to set your non-negotiables: interest rates, monthly payments, and loan amounts. This way, you'll settle for the lender who offers you the most competitive interest rates, manageable monthly payments, and the maximum loan amount you need. Knowing you'll be working with your lending institution for years to come, consider making choices that align with your personal priorities, such as a local bank or credit union that supports your community.

Your entire process for obtaining a home improvement personal loan will look like this:

Step 1: Earmark the home improvements you want to apply and make a guestimate of the total costs. You may want to get a professional quote from a contractor for extensive home renovation projects.

Step 2: Check if your credit score qualifies you for an unsecured home improvement loan. Some credit unions and banks may allow you to pre-qualify following a soft credit check.

Step 3: Compare interest rates and the business practices among different lenders and settle on your ideal partner.

Step 4: Organize the requisite documents, such as tax and financial reports, and proof of identity, address, and income. Then apply for your home improvement loan in person or online.

If your credit score is insufficient, or you don't like the personal loan financing option, you can apply for a secured loan following the same steps, but be sure to avoid having a "hard pull" to your credit more than once. You may find better loan terms with HELOCs or home equity loans if you have no problem putting up your house as collateral and your home's equity is sufficient.

It's your home that matters most

Ultimately, the primary purpose of your personal home improvement loan is to help you renovate and remodel your home to suit your taste. As you seek home improvement loans, don't get caught up in the numbers and lose sight of your main goal: to upgrade your home exquisitely, and love where you live.

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MorePersonal loan scams and traps to avoid

07/06/2021

There’s a smart way to dodge these bullets. Here’s a quick primer on how to identify…

Read More