Why minimum credit card payments are not your friend

Accepted the world over (and all over the world wide web), your credit card turns money into something magical: a plastic genie emerging from wallets and purses, bestowing purchasing power and rewards to all who swipe and sign.

In practice, the credit card has become an indispensable financial tool, but it comes with a price. Or rather, it comes with fees: a service fee, perhaps an annual fee, an occasional "convenience fee," (which isn't terribly convenient for you), perhaps the unexpected late payment fee... and yes, you also get your credit card bill.

The convenience of buying something with your card without giving it a second thought may lull you into believing that your credit card is your friend. But do your friends come with a monthly payment to string you along? More than that, with every passing month that you only make the required minimum payment, you are sinking deeper into debt — and owing your “friend” way more than you originally bargained for.

Let's see if we can find a way to make your credit card at the least, not your financial foe, and perhaps even a useful aid in maintaining your financial well-being.

How your credit card strings you along

When you complete a credit card transaction online, in person, or in a recurring payment for your favorite streaming service, it's not your money you're spending. You're borrowing money from the credit card issuer, and the final cost that you pay can vary greatly. That tiny loan machine in your wallet is just covering the purchase for you until the end of the billing cycle. Unless you pay your balance in full when the bill comes due, you are paying interest on top of the loan you took out when you used your credit card.

As soon as the first credit card payment due date passes since you made that purchase, interest starts accruing. The interest gets translated into a finance charge, and next month it will be one more transaction on your credit card statement. After the second month, you are paying interest on the interest, which makes that initial purchase more expensive than when you bought it. Every month that you carry over a balance from the previous month, those finance charges become your outstanding principal balance.

The cheapest and smartest way to manage your credit card is to pay the balance in full every month. Often, though, you may need to make a purchase that exceeds what you have in your bank account. Even if you use your credit card as an alternate payment method when you aren't sure how much is left on your debit card, if you are using your credit card for purchases greater than your incoming cash flow, you might already be thinking that you are going to float this balance for more than just the current month. Your credit card company knows this, and they are hoping you'll take advantage of their payment option that prolongs that cheap and smart step.

When you receive your credit card statement, one of the required pieces of information on the first page is the minimum payment that you are required to make to avoid late fees (and a possible increase in your interest rate). The minimum payment due is almost always less than the full balance. If you choose to only pay this amount and use your money for other purposes, your credit card company will gladly rollover those transactions — and the fees that go along with them — to your credit card account, hoping you'll only make the minimum payment next month, too.

What are the consequences if you just pay the smaller amount and use your cash elsewhere? The simplest way to answer this question is to examine two scenarios. (Disclaimer: all numbers are for example only.)

Scenario 1: When less equals a lot more

Let's say you've been enjoying a promotional 0.00% Annual Percentage Rate (APR) on your credit card for the last six months, and it's about to change to the standard rate. That $5,000 balance and your new 15.99% APR are about to generate some serious interest.

Minimum payments vary by the financial institution that issued your credit card, but typically the minimum payment is tied to your balance. Let's say yours is $150. This covers the initial cost of interest ($66.63) plus $83.37 that will apply towards the principal. which doesn't feel too bad, especially when you notice that as your balance decreases, so does your minimum payment. Cool!

But then you run those numbers through a credit card payoff calculator and discover that paying the minimum each time leaves you paying the credit card off for close to 17 years, and forking over $3,539.63 in interest. That $5,000 you borrowed will have cost you a grand total of $8,539.63. Not cool!

Scenario 2: Pay more upfront and reap the savings

Now, consider a slightly different scenario starting with the same numbers, but a more consistent payment.

You have a $5,000 balance with a 15.99% APR, and your minimum payment starts at $150. The only difference is that you keep paying $150 even when the "minimum payment" and monthly interest dwindle. This means more of each payment goes directly to the principal balance.

The result? You pay the card off in less than 4 years, and pay $1,655.06 in interest, less than half the amount you paid in the other scenario. Your total cost is $6,655.06.

If you pay even more than the $150 (let's say $200), you pay off the card even faster. You would have the balance paid off in under three years, and the interest would total $1,122.75, saving you another $500. Think about it: That's 10% of the original loan you won't have to pay.

Getting down to zero takes time

It's important to consider that most people don't quit using their credit card cold turkey. The principal balance is likely to fluctuate month to month, depending on how much you use it, so try to use it sparingly. This will change your minimum payment and the amount of time it takes to pay it off. If you use the card for additional purchases, it's best to increase your monthly payment accordingly and avoid accruing interest whenever possible.

The other factor that may impact your credit card balance (and your required minimum payment) is your interest rate. If your credit card includes a fixed rate, that helps. But if the rate is dependent on the prime lending rate, the amount of interest you owe might change, and so could your minimum balance. It's smart to know the terms of your credit card, and to choose the best credit card for you before you even apply for it.

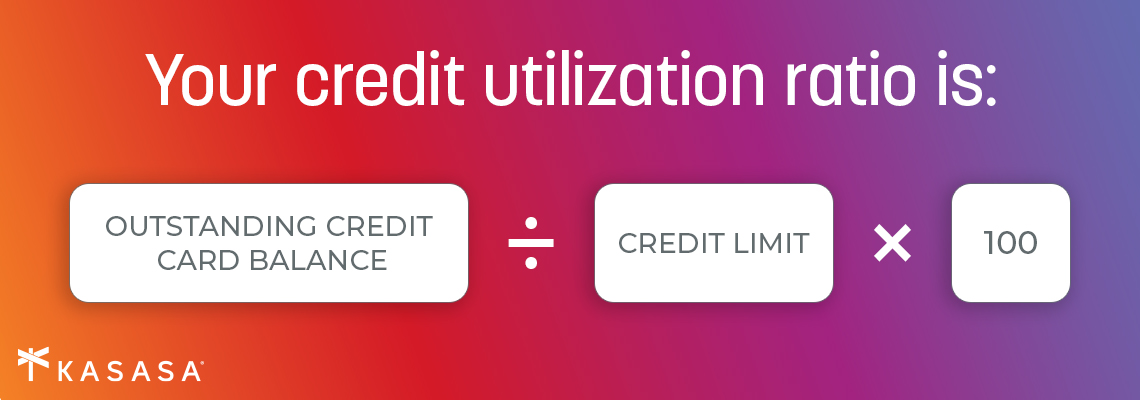

Another smart practice if you do find yourself carrying a balance beyond the transaction month: Be mindful of your credit utilization ratio. If your credit limit is $5,000, try to keep your usage under $1,000. Keeping your usage of all your available credit under 20% will keep your credit score in a healthier range.

The key takeaway is this: Every dollar that you can pay above the minimum payment will help you pay down the principal balance faster, and cost you the least amount of money in terms of fees and interest paid to the credit card company. So even if you can't resist those kicking boots or the getaway to the beach, at least you can stay on friendly terms with your financial wellness plan.

Free checking. Cash rewards. (And zero catch.)

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MoreHow Do Credit Cards Work?

05/27/2020

No one taught me how credit cards work. The result was getting into debt that would haunt me…

Read MorePersonal loan vs credit card: When to use what

07/29/2021

Whether revolving debt or a one-time loan, learn the difference between loans and credit cards,…

Read More