Consider your finance options when making a big-ticket purchase

Whether you're buying the latest flatscreen TV to watch the big game (although, it's not really for the big game since your team isn't even in it this year, but they happen to be on sale so it's a good time to buy), or you want to take advantage of the "end-of-the-season blowout sales" to buy a new washer and dryer, or you know your refrigerator is on its last leg and sounds like it's running 24-7, you have oodles of financing option to cover the cost of that shiny new gadget, appliance, or minor investment in your child's gaming future.

You're not looking to take out a second mortgage just for this purchase, but you want it to be a smart move for you and your budget. You want to score the best deal, but not reinvent the wheel. It's so easy to pull out the credit card and just soak in the added interest and not give it another thought, but let's say we do give it another thought. What are all your finance options? What's the smartest way to take advantage of sale pricing when it isn't a routine purchase, but also not a major investment, and what does your budget have to say about this new expense?

Small personal loans don't jump immediately to mind as the easiest or quickest choice, but they might be your best bet to offset the additional expense without wrecking havoc with your budget's bottom line. So before you run another Google search for the best prices, let's explore all your options to get that new flatscreen installed before kickoff.

Find the right financing option

Credit card loan. Naturally, a lot of us rely on our credit card (or cards, more likely), to cover a purchase that we haven't saved up for, and they offer the added bonus that you can avoid thinking about the upfront cost until much until later. From a convenience standpoint, this is practically effortless, and as long as you pay your bills on time, this may improve your credit score.

On the flip side, you are basically paying for that new refrigerator with credit card debt, which often means you'll pay more money overall. That sale price that you wanted to get on the holiday weekend may likely be spent on monthly interest charges. If you need an unexpected car repair before the refrigerator balance is paid in full, you'll prolong the debt long after the initial installation.

In-store credit card

Don't be surprised if an appliance store, especially a national chain, tells you about their special offers, which include an even lower price, or perhaps even free delivery) for opening a credit card with their store. If you are looking for alternative to using your existing credit card, this definitely is heading you in the wrong direction. If this is your first credit card, it may not be a bad way to establish a credit history, especially if your credit file is "thin." Of course, there are other ways to establish your credit history and possibly with more appealing rates.

If you do already have one or more open credit card accounts, you may find the card terms include a longer-term interest rate less appealing than your current card, plus you can expect it will come with a credit approval process. In addition to a drop in your credit score for expanding your credit utilization ratio, this is now considered "new credit" and also can have an adverse effect on your credit score.

Buy Now Pay Later (BNPL) installments

One of the newest and most popular payment options, especially (but not exclusively) for online purchases, is to receive the merchandise up front by agreeing to make several recurring payments. Services like Affirm and Klarna offer consumers the ability to spread out the total purchase price over several months without having to wait to get their hands on the items like a traditional layaway option.

While only available with participating stores and websites, Buy-Now-Pay-Later options (known as BNPL), might limit your ability to shop around and choose the lowest price, or even support local stores and boost your local economy. Even more challenging, consumer advocates realize this service could leave shoppers in a pickle if they cannot make all the payments, especially since there are no safeguards such as a credit limit or debit card available balance.

Promotional financing

The appliance store or big box store might offer you special financing as part of the sale price. Keep in mind that their number-one priority is to make the sale, not monitor your budget, so it's up to you to decide if this option is viable for you. Often this requires on-the-spot credit approval and chances are the interest rate is non-negotiable.

It's also wise to read the fine print on a sales circular or on the website. The washer and dryer set you want may require a qualifying purchase, such as a matched set when you prefer a different brand of washer versus dryer, or spending more for front-loading washers when you wanted a lower-priced model.

Rent-to-own

Typically offered through stores focused on this service, this option often appeals those less likely to be able to pay in full at the time of purchase, but the caveat lies in being certain of future payment due dates. Missing them can result in significant increases in interest rates and possibly even fees. Always read the fine print and anything with an asterisk. Also, far more money is paid for the rental than the purchase would have cost. Don't be surprised if you also must complete the credit approval process or get locked into a contract that you cannot alter if your finances change.

Personal loan

Often the most cost-effective way to make a large purchase, personal loans allow you to obtain big-ticket or home appliance financing that gives you greater control over the purchase price, the repayment plan, the loan terms, and even where to shop. While less impulsive than many other payment options, you can borrow the money from a reputable financial institution that specializes in loan products. It's a safe bet that the store specializes in home appliances and appliance service and installation rather than personal finances.

With a personal loan in hand, you can shop anywhere, choose any brand, get the best price, and even include installation or delivery fees in the total loan amount. Limiting the surprises that come with add-ons puts you in control of your choices, your debt management, and your budget.

Exceptional benefits of choosing a personal loan

You'll discover upsides and pitfalls to almost any financing option, but personal loans offer the broadest range of benefits if your financial goals are a big part of your decision-making process. If you've made an effort to improve your credit, pay down your higher-interest debts, or stick to a budget to reach bigger goals (like that cruise to Alaska you're planning for your 10th anniversary), a personal loan allows you to prioritize your wants and your needs wisely.

When borrowing through your community financial institution, you can make arrangements for payments to be automatically transferred on a set date to align with your direct deposit. You can discuss whether a lower interest rate or a slightly longer loan term to maintain a set payment that works with your budget - not a random payment amount determined by your credit card company.

When you take out a personal loan, the money you have available to spend is limited. Once your loan is approved, it's deposited in a savings account or checking account, from which you can hit any store, including a local appliance store (because the store sponsors your daughter's volleyball team), and shopping locally builds up others within your community.

You have the ability to build your good credit by making regular payments, a perk that may not work as well with either BNPL or rent-to-own payment plans. Sneaky automatic payments that you turn on and then forget about can land you in high credit card debt, too. If you make your purchase online, be sure to double check the payment method when online shopping.

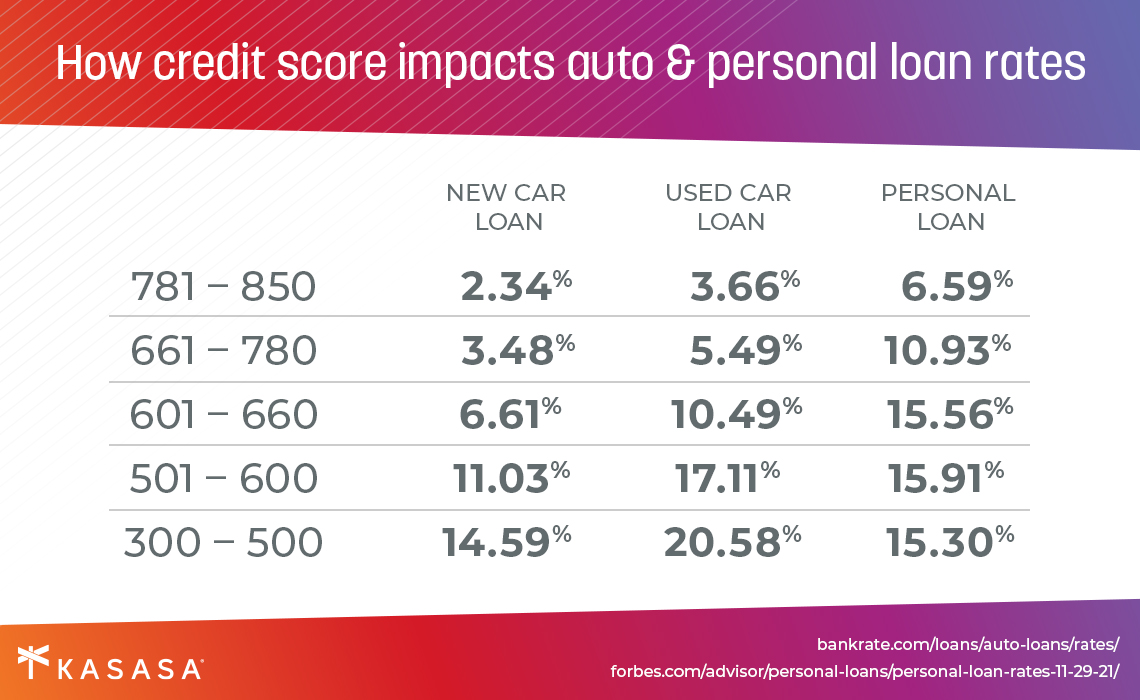

An important point to keep in mind is that with a personal loan, the interest rate you'll get will probably be better than the interest rate on your credit card. The average credit card interest rate is 16.16%; the average personal loan interest rate, meanwhile, hovers at around 10%. The better your credit score, the lower that number goes.

The smartest reason to choose a personal loan

Regardless of all the financing options and which one is best for you, at the end of the day you want to have the new refrigerator silently humming, or the smart TV hanging on the wall being brilliant. But there's one unique way you can be even smarter than your new technological wizard: you can borrow money that gives you the option to pay ahead and pay down the loan, but also take back the money as if it is your own little nest egg.

The Kasasa Loan® gives you total control over all of the variables we just covered, and can help you borrow smarter and avoid instead of racking up more high-interest credit card debt. Our unique Take-Back ® feature lets you reclaim extra money you've already paid toward your loan, giving you access to funds when you need them most. And if you never end up needing them, you get out of debt faster and save on interest.

If you want to know who's going to win the big game, we'll give you the inside edge: it's actually you who comes out the big winner.

Free checking. Cash rewards. (And zero catch.)

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MorePersonal loan scams and traps to avoid

07/06/2021

There’s a smart way to dodge these bullets. Here’s a quick primer on how to identify…

Read More