Personal loan vs credit card: When to use what

It can happen to anyone: You got nailed with a well-placed social media ad and now you need that pricey multi-purpose pan (or memory foam pillow set, or underwear subscription service...). Your three best friends from college are getting married within a month of each other, and you suddenly have a lot of unexpected travel on your itinerary, not to mention gifts to buy. Or your car’s transmission fails at the worst possible time, and you need an emergency repair.

It's natural to instinctively reach for your credit card when tackling an unexpected or unwieldy expense, but this isn’t always the best option. In many scenarios, you will pay less money on a more flexible timeline if you opt for a personal loan instead of a credit card for certain big-ticket expenses.

This guide will explain the difference between personal loans and credit cards, and help you identify which is better for your needs.

What is a credit card? What’s a personal loan?

You might not think about it this way, but your credit card is basically a tiny loan machine. Every time you swipe (or use one of your credit cards as a pre-saved payment method without a second thought), you are technically taking out a personal loan in that amount. This “loan” instantly starts accruing interest (your credit card interest rate), after being tacked on to the rest of your unpaid balance. You pay down your card, and the loan amount (your credit card debt) goes down. Then you make another charge and it goes up again. This is called revolving debt.

A personal loan, on the other hand, is a one-time debt that you take on with a specified initial amount, interest rate, and repayment schedule. In plainer terms: you receive a set amount of money in one lump sum, and pay it back in installments (the same amount every time) over a pre-determined number of months. This is non-revolving debt.

When to use a credit card?

Credit card interest rates are usually higher than personal loan interest rates, and the repayment schedule is less flexible, as anyone who gets a monthly credit card statement knows. Higher interest rates and longer repayment periods mean you end up paying more money in the long run.

That said, there are still some cases when it makes sense for you to stick with your trusty piece of plastic. The small, regular purchases you already use it for can stay: groceries, monthly subscription fees, covering a dinner out with friends. Charging expenses that you know you can easily pay back on time helps you build a higher credit score, a major goal for many people.

Sometimes a credit card can even be used to consolidate multiple smaller debts that you can comfortably repay in a year or less. Be careful, though: this will only benefit you if the credit card comes with a low (or better yet, 0%) interest rate for that first year.

When to use a loan?

One easy way to know if you should use a personal loan is by checking your credit card limit. Let’s say you have two cards, each with a $3,000 limit. If you need to borrow more than $6,000, your credit cards won’t be an option, and you’ll need to take out a personal loan.

Under that ceiling, you’re probably still better off with a personal loan over your credit card(s) for large purchases that will take a year or more to repay. This depends on your personal financial situation, of course, but if the amount you need to cover is more than a few thousand dollars, a personal loan will usually be a better choice.

The same goes for emergency expenses that you can’t comfortably pay out of pocket: that dang transmission failure, an unplanned visit to the veterinarian, all the rainy days that life likes to throw at you. A personal loan can blunt the shock of an unexpected bill, usually for a better rate than a credit card.

What about credit score?

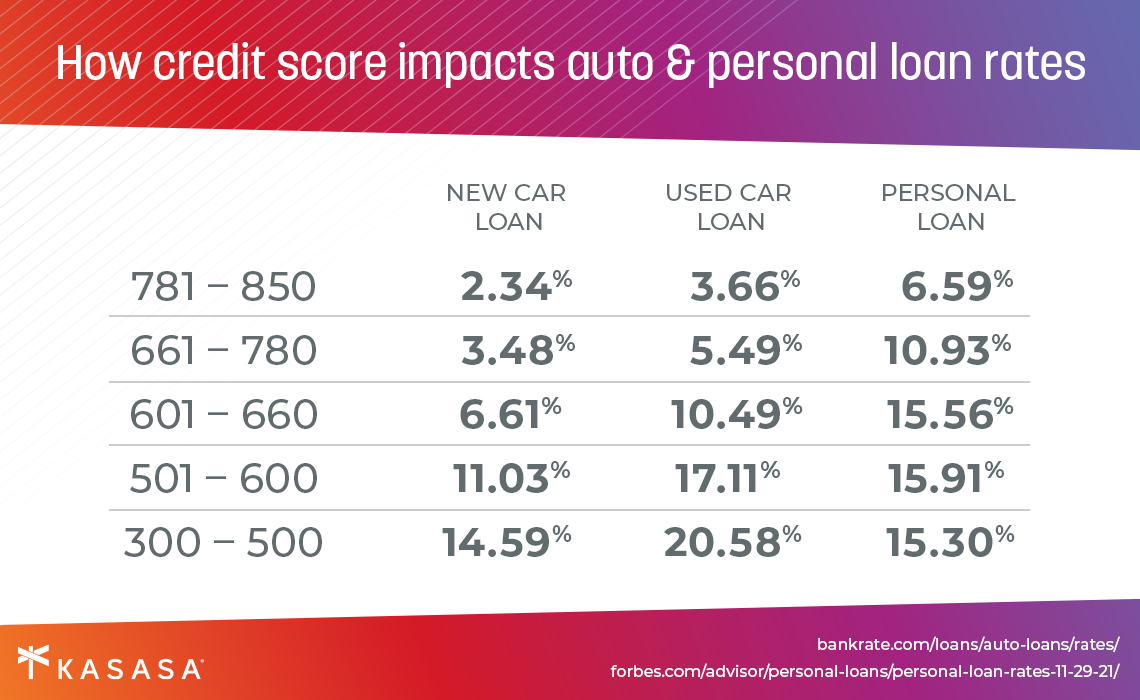

Whether you can get a better rate on a loan vs a credit card will depend largely on your credit score. The higher your credit score, the lower the interest rate you’ll get on a loan offer; the lower the rate, the less you pay total. You’ll usually want to choose a personal loan over credit card for big-ticket purchases if you have good credit. If you have a low credit score, responsible credit card use will bump you up over time.

Personal loans will almost always involve a more flexible repayment plan, though. Clarity on the repayment timeline gives peace of mind in addition to confidence knowing that you’re saving money. And on-time loan repayments also tend to have a positive impact on credit score.

How to choose the best personal loan?

There are a lot of moving parts to consider when choosing a loan: interest rate, fees, monthly payment amount, and repayment period are among the most important. A Kasasa Loan® will give you total control over these variables, and help you borrow smarter instead of racking up more high-interest credit card debt when it can be avoided.

You don’t get charged any fees, and our unique Take-Back™ feature lets you reclaim money you’ve already paid toward your loan, giving you access to funds when you need them most. A Kasasa personal loan gives you flexibility for life’s uncertainties, so you can get out of debt faster and still be prepared for life's next curveball.

Free checking. Cash rewards. (And zero catch.)

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MoreHow Do Credit Cards Work?

05/27/2020

No one taught me how credit cards work. The result was getting into debt that would haunt me…

Read MorePersonal loan vs credit card: When to use what

07/29/2021

Whether revolving debt or a one-time loan, learn the difference between loans and credit cards,…

Read More