How Do Credit Cards Work?

I was 18 when I got my first credit card. There was a booth on my college campus offering a t-shirt and a voucher to the local pizza buffet if you applied. Back then, that might as well have been gold. A few weeks later a card arrived in the mail. I suddenly went from being broke to having a line of credit. I had it, so I spent it. I then spent the next couple of years paying off interest on what should have been a cheap purchase. No one had ever taught me how credit cards work, and I had never bothered to ask. Here are lessons I wish I learned early on.

The Application Process

The first step is to find the right card for you. You should consider three things:

-

What is the interest rate (APR)?

-

What rewards does the card offer?

-

How will it impact my finances?

There are plenty of websites out there that will help you compare rates and rewards of different credit cards. Once you find the one that is right for you, you'll need to complete an application. To determine if you're approved or denied, the credit card issuer will look at several things:

-

Credit Score

-

Credit Report

-

Stability of Income

Your credit report reveals information like: Do you make your payments on time? What other credit cards do you have? Have you had other recent inquiries into your credit? Have you ever had a bankruptcy? How long have you been employed?

Source: moneyunder30.com

Source: moneyunder30.com

The better the history/credit score, the more options you'll have available to you and you'll get a higher limit and better APR. If you have a bad credit score, it will be harder, but there are credit cards out there that might accept you.

You should know your credit score before you apply so you know which cards you have a chance to be approved for. If you are denied too many times in a year, it can have a negative impact on your credit score.

If you do have a bad credit score, you might want to look at a secured credit card. A secured card acts like a normal credit card except that you have to make a deposit in order to be approved. This deposit is typically the same as your credit limit. For example, if you have a limit of $200, then you will need to deposit $200.

How Credit Limits are Determined

Your credit limit is the maximum amount you can spend on the credit card. If you have good credit, this number might just be a starting credit limit and you can adjust it by contacting the provider and asking for an increase.

Every credit card company has its own formula to determine your credit limit, but the process is similar to that of the approval process. They look at your:

-

Credit report

-

Credit score

-

Debt-to-Income ratio (DTI). This is your recurring monthly debt divided by your gross monthly income. So if I make $2,000 a month and I have $1,000 in recurring monthly bills, I have a DTI of 50% ($1,000 / $2,000). There is a "magic number" that many lenders use which is 36. Your total debts should not exceed 36%.

The average credit card limit is $22,751, according to the latest 2019 Experian data.

One important side note about credit limits is that if you regularly exceed 30% of your total, it can lower your credit score. This is known as your "credit utilization." So, if you so have a low credit limit, make sure that you are careful about what you put on the card.

How Credit Card Processing Works

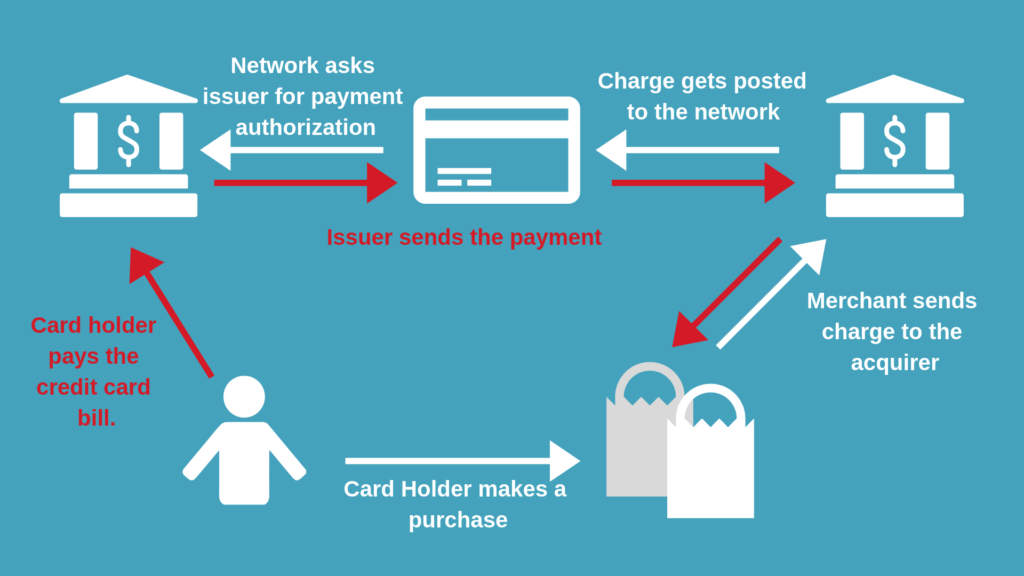

There are several characters in this story: the merchant (the store where you are shopping), the acquirer (typically the merchant's bank), the network (the logo on the card, like Visa or Mastercard), and the card issuer (your bank).

When you swipe your credit card, a signal is sent to the card issuer to see if you're approved or denied (or if they suspect this is a fraudulent purchase).

Once the merchant gets the approved message, you are good to go. But that’s not the end of the journey for your credit card charge.

At the end of the business day, the merchant sends all transactions to an acquirer who then sends it to the network. The network then sends it to the issuer who adds the purchase to your monthly bill.

You might have noticed that the payment had to go up and down a chain of people. They don’t work for free. They take fees out of your total payment. We’ll talk about those in more detail a little later.

Can Credit Cards be used as Debit Cards

The answer is typically no. A debit card is different from a credit card as it takes the funds out of a linked checking account in real time. Credit cards aren’t linked with a specific account and put the charge on your line of credit to be paid off at a later date.

The answer is “typically no” because there are some apps or accounts that are “hybrid” accounts. Basically, they automate the payment of your card balances in full at the end of each month. However, unlike a true debit card, these transactions don’t happen in real time, so you need to make sure you keep note of how much you have spent through the course of the month.

How Credit Card Companies Make Money

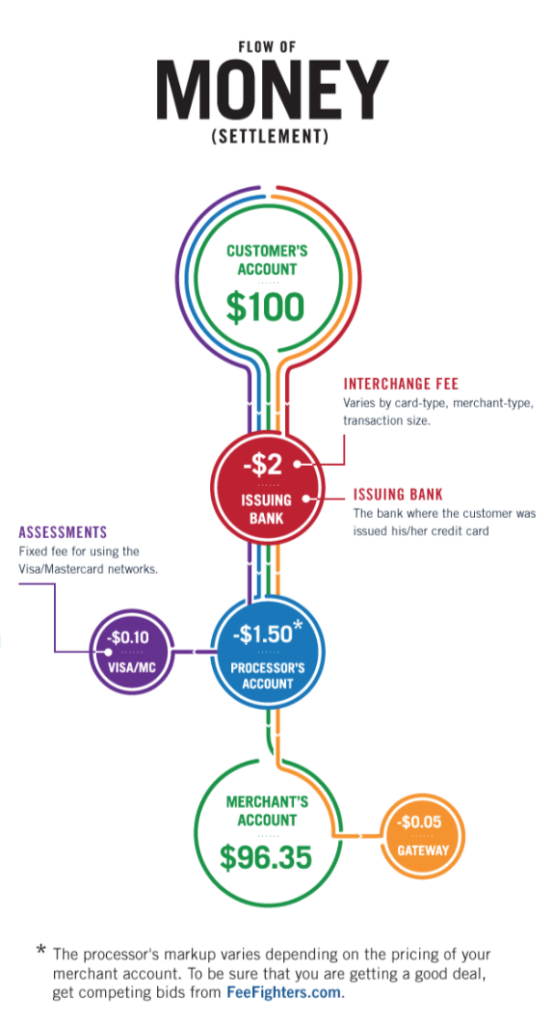

Remember all those people involved in making sure the credit happened? Each one of them wants to be paid for their part.

-

Issuer – This is the bank that issued you the credit card. They take a cut called “interchange.”

-

Acquirer – This is the bank that works with the merchant and allows them to run credit cards. They charge an acquiring fee.

-

Network – This is the brand name on the credit card. They take a small fee, too.

Let’s say you buy a $100 worth of groceries. The acquirer will keep $0.19. The network will keep $0.13, and the issuer will keep $2.20. At the end of this journey, the merchant receives the $97.25 that remains after all the fees have been taken out.

This is why you might find cheaper “cash prices” or stores require a minimum for a credit card purchase. If there was a $1.00 purchase for a drink, there would barely be any money left after all the fees, making it not profitable for the merchant.

How Credit Card Interest Works

The other way the credit card network makes money is by charging you interest (APR) and penalty fees. Let’s look at that same $100 purchase you made above and pretend that you made a minimum payment of $30. This would mean you have a balance of $70 still sitting on the credit card.

Now, pretend the credit card has an APR of 24%. The APR is the total percentage you would pay over the course of the year, so to figure out how much you will pay in a month you can divide the number by 12. That means we will pay 2% (24% divided by 12 months) interest on our balance of $70.

2% of our $70 balance means $1.40 in interest owed. At the end of the month, we are charged that amount and our new balance is $71.40. The next month we would be charged another 2%. This happens every month we carry an outstanding balance.

How Credit Card Fees Work

There are also fees that can be applied to your account. The most common is the late fee. This is a charge added to your balance if you haven’t made the minimum payment by the due date. Regardless of which credit card you have, late fees are capped at $27.

Going back to my $100 grocery example, imagine that I make my minimum payment a couple days late. They would first add the 2% interest charge to the $100 balance ($102) and then add the $27 late fee ($129) – I make my minimum payment of $30, but my new balance is $99. Even though I paid $30, my balance is just $1 lower than the cost of the item I purchased. You can see how people get into trouble with credit card debt quickly.

Some other common fees are:

-

Annual Fee — Paid annually for the privilege of carrying a specific card. Cards will annual fees usually come with more benefits and rewards.

-

Balance transfer Fee — This is incurred by moving a balance from one credit card to another. The fee is usually 3% or $5, whichever is more.

-

Cash advance Fee — This happens when you convert some of your credit lines into cash. The fee is usually 5% or $10, whichever is greater.

-

Expedited Payment Fee — Pretend your bill's due date is tomorrow and you don’t want a late payment of $27. You can make sure you get your payment in before the deadline, but there might be an "expedited payment fee." These are usually between $10-$15, which is a lot, but not as much as the late payment fee. Plus, it isn’t reflected on your credit history.

-

Foreign Transaction Fee — This is a fee imposed when you use your card abroad and your issuer has to convert currency to USD. It is typically 3% of the transaction. However, there are plenty of travel cards where the main perk is the waiving of this fee, so if international travel is important to you, make sure you look for this perk.

Now that you have an understanding of how credit cards work and the potential fees associated with them, you can go out there and compare with confidence. If you want to get some tips on improving your credit score before you start applying, check out this resource.

Free checking. Cash rewards. (And zero catch.)

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MoreHow Do Credit Cards Work?

05/27/2020

No one taught me how credit cards work. The result was getting into debt that would haunt me…

Read MorePersonal loan vs credit card: When to use what

07/29/2021

Whether revolving debt or a one-time loan, learn the difference between loans and credit cards,…

Read More