What credit score do you need for an auto loan?

Everyone knows that cars are expensive (not to mention sales tax), but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

What’s a credit score?

Your credit score is a three-digit number that gives lenders an estimate as to your ability to manage your credit, and to repay your loan. Three consumer credit reporting bureaus - Equifax, Experian and TransUnion - provide the information from your financing and payment history that ultimately generates your score. While FICO isn't the only score tabulated, it comes up commonly when you are completing a credit application, because it's one of the most common scores used by the majority of financial institutions in the United States.

Every consumer has a FICO score that falls within the range of 300 and 850. Your credit score comes up in the lending equation because that's what your bank or credit union (or car dealership or credit card company) use to determine whether or not to loan you money whether that's a personal loan, credit card, student loan, refinance of an existing auto loan, or a line of credit. If you have excellent credit, you'll get better terms, such as a competitive rate, or a higher dollar amount of available credit.

What do lenders look for in a credit score?

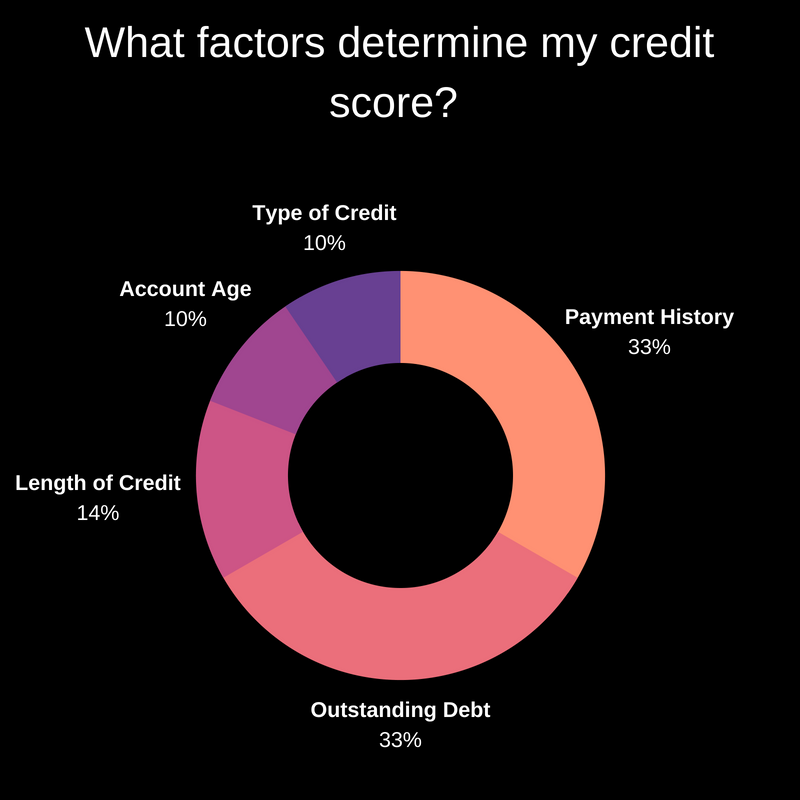

In short, lenders want to get paid. The dealership or the bank or credit union are trying to assess the likelihood that you will be able to pay them back. They do this by performing a risk assessment based on your credit history and your current finances, largely informed by your FICO credit score. This score is based on information from your credit report and your current monthly payment plan of any existing credit sources. Five main components comprise your credit score, each with a different associated weight.

Payment History — 35%

How well you have kept up with monthly payment plans, credit card payments, and loan terms as a previous borrower make up a good chunk of your credit score. Late or missed payments, a mortgage default, and bankruptcy all damage this section of your credit report, but paying down a loan early or keeping low balances on past credit card balances help you work towards an excellent credit score.

Outstanding Debt — 30%

Naturally, the less debt you have, the greater your chances are of securing credit. After all, the more you owe, the the more challenging it will be to pay it all back. You may hear this assessment referred to as your "credit utilization score." Of the open lines credit you do have (your current credit card, a student loan, etc.), ideally you want to use less than 30% of your total available credit.

Length of Credit History — 14%

Have you been a borrower for long time? A lengthy track record of responsible credit use is good for your credit rating, which is obviously much more difficult to gain when you're in your early twenties. This explains why older generations typically have the best credit scores. The frequency with which you use your cards also plays a role, so if you have a credit card, use it a little bit to show that you can manage your debt responsibly.

Account Age — 10%

Your age isn't the only years that matter. Having a long-term, well established credit history on each account can result in an excellent credit rating. However, if you open a bunch of new credit cards in a short amount of time, that lowers your overall FICO score. Lenders will have questions about your ability to repay the debt should you suddenly choose to max out all those cards. Also, and less commonly known, you also don't want to close any lines of credit right before applying for an auto loan.

Types of Credit Used — 10%

From a lender's perspective, variety is good, so paying down a credit card balance when you use it and making an automatic payment on your student loan each month shows you can handle different types of debt. Lenders want to see that a borrower has experience using multiple sources of credit in reliable ways.

What is a good credit score for an auto loan?

While lenders can set their own standards when assessing an individual's FICO score, generally accepted standards across the board for multiple lenders. According to Experian, "higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed."

So what's a "good" credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build your score over 800, you can pretty much be assured of your excellent credit and an ace up your sleeve when negotiating your annual percentage rate and your loan terms. However, if you credit score is higher than 600 and lower than 750, you're in line with most borrowers. The average credit score in America is 657.

How do I check my credit score?

If you aren't already checking your credit score regularly, you can request a free report regularly. If there are any surprises, or "dings" on your credit report that may be incorrect, you can go directly to Equifax, TransUnion, or Experian to correct what may be negatively impacting it.

Should I get pre-approved for my auto loan?

It's not a bad idea to get pre-approved for a car loan from a bank or credit union before even shopping at a dealership. A pre-approved offer guarantees that you have a loan to cover the cost of the car you want. It also makes for a nice bargaining chip at the dealership because they will know you are serious about buying a car and the dealer will want to make the sale.

Another smart reason to get a pre-approval will help avoid each auto dealer you visit dipping into your good credit. According to blog.credit.com, "Credit inquiries related to auto loans made within a short time frame (usually 14 or 45 days depending on the credit score model being used) are supposed to count as a single inquiry. However, some of our readers have found their credit scores dropping after multiple car dealers sent credit inquiries for financing. This is another reason why getting pre-approved before going to the dealership is a good idea."

Can I still get an auto loan with bad credit?

Yes, credit is a major factor in getting an auto loan, but you should also keep in mind that most dealers really want to sell you a car. They're often willing to work with you in order to do so. Nerdwallet points out that, "...at the end of 2017, the average credit score for a new-car loan was 713, and 656 for a used-car loan, according to an Experian report. But nearly 20% of car loans go to borrowers with credit scores below 600, according to Experian. Almost 4% go to those with scores below 500."

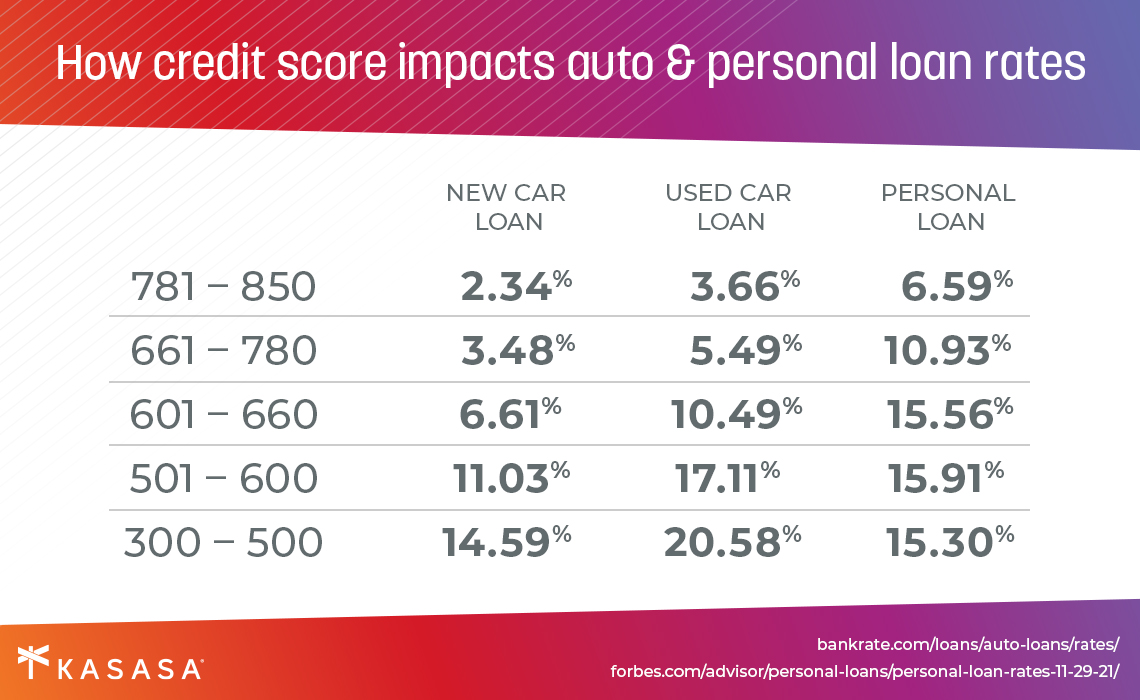

While you'll likely be able to get a vehicle loan with less-than-stellar credit, it might have a pretty significant impact on the maximum loan amount, the loan term, or the annual percentage rate that you receive. So the worse your credit is, the higher the rate, the longer the monthly payment schedule might be, and the less money you might be able to borrow towards your new (or new-to-you) vehicle.

How does my credit score affect my auto loan rate?

Depending on your credit score, the interest rate you receive can vary widely. In fact, the difference in interest rates on a new car loan for someone with excellent credit versus someone with very poor credit can vary by as much as ten percentage points.

Use our 3-step loan calculator to determine the difference in interest rates.

For example, if your excellent credit qualifies you for a 6% interest rate on an $18,000 vehicle rather than the 12% interest rate for which a less-than-stellar credit score might qualify, you'll save more than $50 each month over the five-year term of the vehicle loan. That's a $3,000 savings thanks to your good credit!

When it comes to car buying, your credit score plays a major role in the type of financing that's available to you. For people with a strong score, this works in your favor. You might be in the perfect position to obtain an auto loan.

For those with lower scores or no credit, this may pose a bit of a challenge, but don't despair! There are actionable steps you can take toward improving your score. The good news is that a properly managed auto loan (where you make timely payments) can improve your credit score moving forward. So once you secure an auto loan, you can work toward strengthening your credit history for your next car, truck, or recreational vehicle.

Now that you are armed with all the facts you need to obtain an auto loan, all that's left to do is find the right vehicle for you.

It’s a great feeling when you pay ahead on your loan debt. Especially right before your check engine light comes on.

What credit score do you need for an auto loan?

07/19/2018

If you decide to finance your next car, pay attention to your credit score, which affects the…

Read MoreHow To Get A Car Loan With Bad Credit

10/04/2018

Is it possible to get a car loan with bad credit? Here are tips to help land your new ride, while…

Read MoreShould You Ever Get A Title Loan?

10/05/2018

A title loan might seem like a great way to get quick cash, but what they won't tell you is the…

Read More