How much house can you actually afford?

When planning to purchase a home, it’s fun to fantasize and picture yourself in your dream home. If you’ve narrowed down the neighborhoods you want to look in and made your list of must-haves and nice-to-haves, you've hopefully already considered how much you can afford.

We’ve all heard the phrase “house poor” — when you spend so much of your income on your mortgage, utilities, taxes, and maintenance that you don’t have the money to do much else. With this in mind, it’s important not to spend time looking at houses outside of your budget. Here are some simple formulas, tips, and references to help you find a house you’re comfortable paying for and a home you're happily living in for years to come.

Build your credit

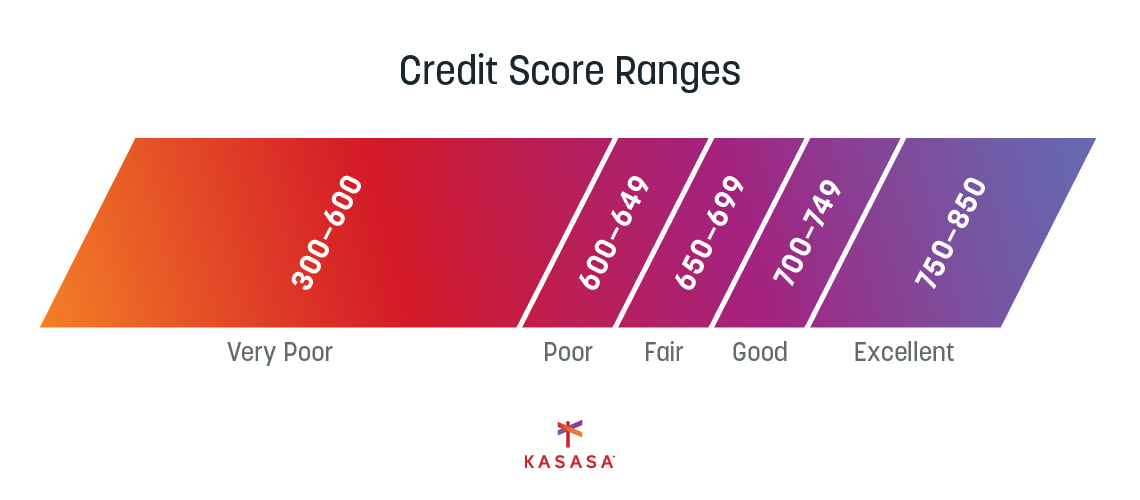

This is Borrowing 101: In order to qualify for a loan, you want to have a good credit score. The better the credit score, the better interest rate you will be able to get when you apply for your mortgage. At this stage, you likely aren't ready to shop for a home loan, but building your credit takes time and effort, so it's the best place to get started.

Having a checking or savings account that reflects your income and spending plus paying your bills on time equals the two most important indicators of good credit. To continue building your credit, try to diminish your outstanding debt and keep existing debt in check. The goal is to improve your credit score and your debt-to-income ratio.

Know your debt-to-income ratio

Your debt-to-income ratio is the amount of debt you have (credit card payments, student loans, auto loans, etc.) compared to your overall income. The ratio helps mortgage lenders evaluate how much additional debt you can handle, helping them to decide whether or not to give you a home loan.

As a rule of thumb, you should aim to have a low debt-to-income ratio, ideally less than 36% to qualify comfortably for a home loan. To calculate, simply add up your recurring monthly loan obligations (including any money you owe that is included on your credit report).

Your income can include any earnings, as well as any money you generate from investment properties or other additional revenue sources. Simply divide by your gross monthly income, or use this helpful Bankrate.com calculator to quickly find your ratio.

Calculate your mortgage payment

Again, you may still not be ready to apply for a home loan, but you will want to figure out how much you can afford each month for a home payment. This will be based on the terms of your mortgage and the total amount you plan to borrow.

Figure out the purchase price you can afford using a mortgage calculator. This calculator factors in the current interest rate for your area and different loan types to help you determine what your payment will be. Investopedia’s Mortgage Calculator will provide the calculations.

Try a range of numbers that adjust for a variety of downpayment amounts and interest rates. Even if you qualify for a great rate, they can change between when you start planning and when you close the deal. Revisit the calculator from time to time and see how your plan is narrowing towards reality.

Save for your downpayment

Once you know how much you intend to borrow, you can set a savings goal for your downpayment. Of course, you can begin saving for your future home at any time, so the timing on this step can be as soon as you earn your first paycheck, or once you decide you are tired of renting. The choice is yours, but the sooner you start saving, the more downpayment you can set aside. and the lower your monthly mortgage payment can be.

Set up a savings plan and evaluate your current spending habits to fit your budget. You could even consider earning extra money from a side job, project, or hobby. There are many finance and budgeting programs and apps to assist you. You might also qualify for downpayment assistance depending on the type of loans available to you.

Consider private mortgage insurance

If you can’t afford to make a down payment of at least 20% on your home, you’ll need to consider private mortgage insurance or PMI. PMI protects your mortgage lender if you default on your home loan. PMI fees depend on the size of your down payment as well as your credit score, requiring a monthly payment.

Keep your goal in focus

Don’t let the intimidating process of buying a home keep you from achieving your goals. Use these tips to get started and formulate a plan and you’ll be on your way toward affording your dream home. You can do this.