Does your loan come with Take-Backs™?

We've all been in situations we wish we could erase or change. It would be so nice to go back in time and make some tweaks, like not saying that one thing you definitely shouldn’t have said, or not making that little mistake that will play out in your head on repeat for years to come. (Yeah... that one.)

The good news is at least you know you're human! The bad news: Time travel is still impossible.

We can’t help you undo the boneheaded comment you made to your partner, or that poorly timed coffee spill. Those will fade from memory over time. Financial mistakes, on the other hand... those can impact you for years to come.

Take loans, for example. Chances are high you’ve taken out and are currently paying down some kind of loan in your life journey, whether it’s an undergrad student loan, reverse mortgages, or something in between. Even your credit card is a personal loan machine in a way. Every time you rack up a charge you’re basically taking out a loan in that amount with your credit card issuer. The interest rate and repayment terms you agree to with all of these loans affect your credit score and shape your finances for years to come.

You know it's smart to pay your debt off sooner, but you also deal with the nagging "what if" scenarios in the back of your mind. (What if my fridge dies? What if my car breaks down?) Pay off your loan faster or build an emergency fund?

Why not both?

Introducing the Kasasa Loan®, the only loan with Take-Backs so you can pay ahead… and get that money back penalty-free if you need it. Here’s how Take-Backs work, and how to get you some.

What is a Take-Back®?

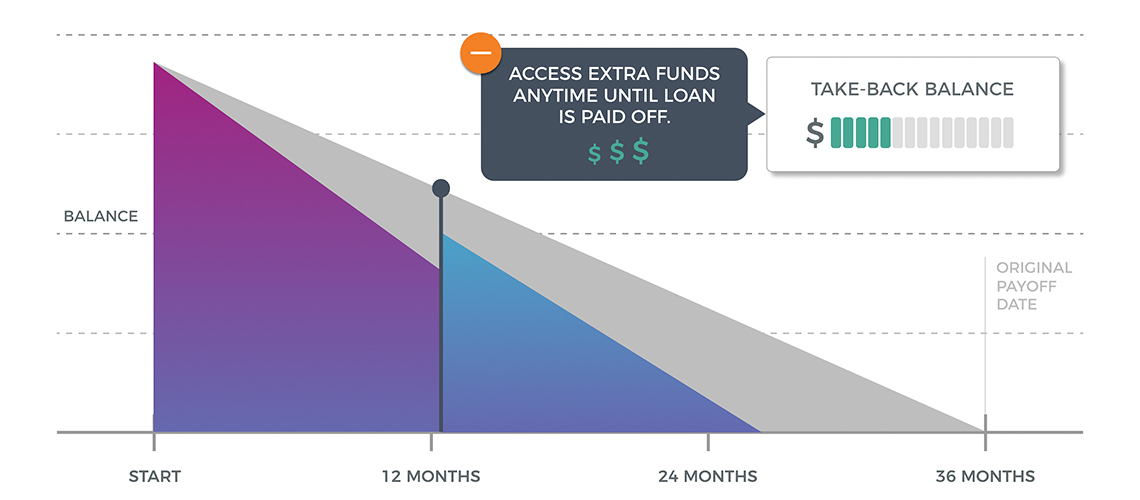

A Take-Back is the ability to withdraw anything extra you've paid toward your loan amount, at any time, for any reason. If you've overpaid on your loan to try and get out of debt sooner, but suddenly you need that money, you can get it.

How do Take-Backs work?

It all comes down to how you choose to make your loan payment (specifically, how much you are able to overpay on your monthly payment), and how you plan to use your personal loan.

You can choose to pay the minimum monthly payment and stay on track to pay off your loan as projected (aka, treat it like any regular loan out there, like the student loan or auto loan repayment that you pretty much make on autopilot).

Or, if you have extra funds, you can choose to put them toward your balance as extra payments to get ahead and save on interest. In this way, the Kasasa Loan is just like most other loans — pay ahead, get out of debt sooner and save big on interest. But those other loans don’t come with Take-Backs.

If life throws you a curveball, or your financial priorities shift, you can withdraw some or all of the funds you paid ahead on, beyond your normal required payments.

The funds are transferred into your account, and your loan balance and payoff schedule automatically adjust to reflect the change. You’re still making all your loan repayments on time — just getting Take-Backs when you need them. Your loan term (also known as the repayment period) doesn’t change.

What does a loan with Take-Backs look like?

Say you got a nice bonus from work (high five!), and you decide to put it toward paying off your auto loan sooner. Then a few months later, a once-in-a-lifetime travel opportunity pops up, and you could use some extra cash. You could dip into the extra funds you've accumulated on your loan to cover your travel expenses. Your loan would then automatically shift back the payoff timeline to reflect this change, but never beyond where you would naturally be had you never paid ahead.

What are the benefits of a loan with Take-Backs?

You may be thinking, "What's so great about this loan? Isn’t it basically just a line of credit?" There are several benefits to choosing Take-Back loans.

1. The Kasasa Loan lets you get out of debt faster.

When you know you have a "rainy day" or "uh-oh insurance" fund, it makes it a whole lot easier to apply cash you may have otherwise held onto toward your loan. Even if something does come up along the way and you need to dip into those funds, you may not need to use your entire Take-Back balance. It's also more likely you'll get into the habit of consistently making higher payments toward your debt, which helps you to...

2. Pay off your loan sooner and save on interest.

Anything extra you pay on top of your regular monthly payment is automatically applied toward the principal balance of your loan. There are many benefits to paying off your debt sooner — check out our article Why pay more than the minimum? to learn more about adjusting your repayment plan to escape debt faster. In a nutshell, paying down your loan on a shorter timeline reduces the amount of interest owed and thus, the total amount in repayments made over the total life of the personal loan.

3. You have more visibility into where you stand on your loan.

Rather than digging up old amortization tables, managing your loan is super simple with a Kasasa Loan. Your loan status is reflected in real time and always available via a mobile app.

An easy-to-understand graph breaks down numbers from finance speak into an interface that's super easy to understand and use. You can even play around with the platform to test different scenarios you're considering, like how long it would take to pay off your loan if you paid $X amount extra each month, or what it would look like if you used funds from your Take-Back balance.

4. It's easier and (usually) cheaper than securing a line of credit.

With a line of credit, your terms continue to extend as you take out additional funds, so there's an indefinite ending. With a Kasasa Loan, the terms will never go beyond your original plan. Plus, a line of credit typically entails more long-term, holistic planning. With a Kasasa Loan, on the other hand, you can easily take a private loan out for one simple need at the time, but still be able to cover other things that come up along the way.

Do Take-Backs cost me anything to use?

Your next thought might be along the lines of, "All this sounds good, but surely there's some sort of catch?" Totally valid question based on what you've probably grown accustomed to as the banking norm (especially in the land of too-big-to-fail megabanks).

But in this case, there is no catch. There are no penalties or fees for withdrawing a Take-Back or paying ahead on your loan. The interest rate stays the same the entire time, and the loan term remains in your control.

Do all loans come with Take-Backs?

It certainly feels like this feature is a no-brainer, and that all loans should come with it... The reality is that Kasasa Loans® are the first and only loans that come with Take-Backs.

How can I get a loan with Take-Backs?

Great question! Kasasa Loans are exclusively available at community banks and credit unions: financial institutions that prioritize putting people before profits.

You can't find Take-Back loans at the big banks that, well, do the opposite.

A Kasasa Loan will give you total control over your loans. The Kasasa Loan gives you fine-tuned control over your repayment plan, letting you play with repayment options depending on how your goals and circumstances change over time. You have a lot of choices when it comes to what kind of loan servicer to use — Kasasa uniquely has a nationwide network of community banks and credit unions that’ll keep your money local.

Plus, Take-Back loans from Kasasa help you borrow smarter instead of racking up more credit card debt when it can be avoided. Take-Backs let you reclaim extra money you’ve already paid toward your loan, and access funds when you need them most. A Kasasa personal loan is the best place to start taking control of your debt!

It’s a great feeling when you pay ahead on your loan debt. Especially right before your check engine light comes on.

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MorePersonal loan scams and traps to avoid

07/06/2021

There’s a smart way to dodge these bullets. Here’s a quick primer on how to identify…

Read More