Why ? and when ? to refinance your auto loan

Lots of us get into bad auto loans, due to lack of experience, unfortunate circumstances, or a combination of both. People at the beginning of their financial journey in particular pay higher interest rates on car loans, because from a lender’s point of view, they haven’t proven they can pay back money on time. They have a “thin” credit file, meaning there’s not enough information in their credit history to be confident about their ability to repay. One of the costs of being young!

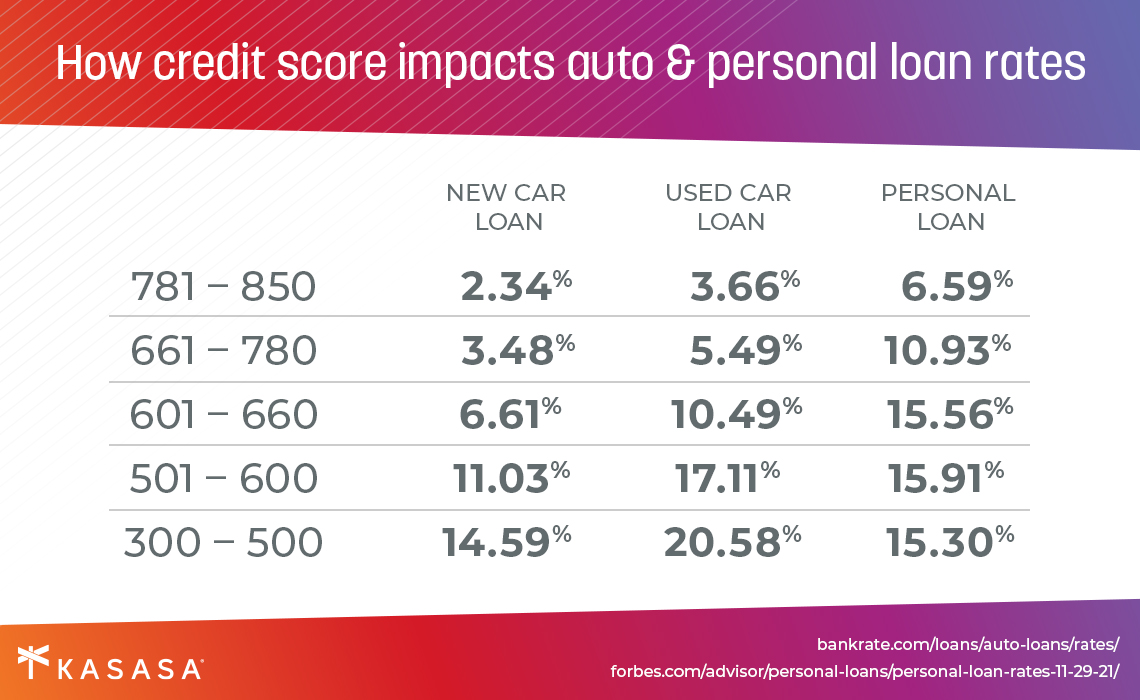

Others may need to get a new car when their credit score is way lower than they’d like it to be. Any number of factors can positively influence credit score, and maybe a year or 18 months into your loan, your credit has improved and you’re thinking it’s time to renegotiate the terms of your auto loan.

No matter where you sit, there are some crucial pros and cons to consider before refinancing your auto loan. We'll walk you through the reasons to refinance, some of the potential downsides, when and why it may be right for you, and what you should know before you research new deals.

The pros of auto refinancing

There are definite upsides to refinancing your current car or truck loan, especially if you are not planning on purchasing a new vehicle anytime soon.

Lower your monthly loan payments

Spending less in your monthly payment is probably the #1 reason most people look into auto loan refinancing. Depending on the interest rate of your current auto loan, refinancing can save you up to hundreds of dollars a month, freeing up much needed cash flow. As a general rule of thumb, though, a lower monthly payment translates to more money paid in the long run. Make sure you read to the end of this blog!

Pay less interest on your auto loan

You’ve been around the block enough times by now to know that when shopping for a new set of wheels, the sticker price you see is not the same thing as the price you end up paying, unless you’re paying in full up front. If you finance your car, interest will be added to your total cost, meaning you’ll repay the original loan amount (aka the principal) plus an extra amount on top determined by the interest rate and the repayment schedule, or loan term.

For example, a $15,000 car financed at 3.5% for 60 months will cost you $16,380 in the end: the original amount, plus a total of $1,380 in interest. If you had the same deal financed at 3.0%, it would save you $180. Shopping around for a better interest rate is another super common reason people consider refinancing. (Search for “auto refinance calculator” and you can play with some numbers yourself.)

Remove or add a co-signer

If you were young or had a bad credit score when you purchased your car, you may have needed the help of a co-signer. This is someone with a healthier financial profile that agrees to assume some of the risk that’s being taken by the lending financial institution. Makes a lot of sense at 20, but indefinitely sharing ownership of your vehicle with your parents isn’t ideal. When you refinance your existing loan, you are making a whole new agreement with the lender.

Change lenders

On the same note, if you are unhappy for whatever reason with the financial institution that issued your current auto loan, you can refinance elsewhere. In addition to the key factors mentioned above —?the loan term, repayment timeline, and interest rate — there are certain intangibles that are hard to see when you’re just starting out in your financial journey. Many people pursue an auto refinance loan at a small, local bank or credit union instead of a major lender for the extra layer of customer service and care that local lenders provide.

The cons of auto refinancing

Sounds good, right? But there are other considerations, too.

You might spend more over the long run

As mentioned above, a lower monthly payment is an attractive reason to refinance your auto, but it can sometimes mean you pay more interest in the long run. A lower payment usually means a longer loan term, which means more money spent overall during the life of the loan.

Imagine your original loan was for $15,000 financed at 3.5% for 48 months. Your monthly payment is $335. To keep this example within readable math terms, we'll pretend you're refinancing the full $15,000 at the same rate of 3.5%, but you’re extending the loan term to 60 months. Your new monthly payment drops to $273. Having the extra $62 a month might be worth the change, but you should know the tradeoff: with the 48-month loan, the total amount you pay back is $16,080, but with the 60-month auto refinance loan, the total amount you pay is $16,380.

Your credit score might be impacted

Refinancing your auto loan can negatively affect your credit score. This is a concern for many people, especially people who are forced to get into a higher interest rate auto loan than they would have liked because of a low credit score. The good news is that in most cases, your credit score only takes a small and temporary hit when you take out an auto refinance loan.

How does auto refinancing affect your credit score?

There are three major areas refinancing will affect when it comes to credit.

Credit inquiry

Any lending financial institution, from the biggest megabank to the tiniest one-shop credit union, will need to pull your credit score in order to determine what interest rates they can offer on your auto refi loan. The industry lingo for the kind of credit check that’s done when you apply for a new line of credit (like a loan of any kind) is a “hard pull,” and too many hard pulls done in too short a time can hurt your credit score.

You can help minimize the impact by researching financial institutions before you apply, and determining which lenders are offering the best interest rate and loan term for your needs. If you know your credit score, you can ask a potential lender what rates they believe they could provide. It’s fine to send loan applications out to multiple auto lenders, but if you go that route, it’s best to submit all the loan applications within a 14-day window. These inquiries will typically be grouped into one “hard pull."

Change in credit utilization

Credit utilization is the percentage of your credit that you have currently spent. For example: If you have a $100 credit card limit, and you buy something that costs $30, you’re utilizing 30% of your credit. A general rule of thumb for creating a good credit score is to not use more than 30% of your credit. Refinancing your auto loan can change the percent of credit that you are utilizing, which could result in a lowered score.

Change in payment history

Your history of loan repayments is arguably the most important factor in establishing good credit, as is the age of credit lines. Both factors give a financial institution information about your ability to repay on time and consistently. When you refinance, you essentially delete the previous line of credit, meaning you lose that repayment history. As long as you’re making your new loan payments on time after refinancing, this will even out, but be sure that you don’t miss the last payment on the original loan.

When should you refinance your auto loan?

Is now the right time? That answer may be different for every vehicle owner. Here are some considerations:

Your credit score improved

A lot of us, especially first-timers, finance a new car purchase even though we have less than stellar credit. As we get older and (hopefully) our credit scores improve, we get access to better interest rates for auto refinancing. This is one of many reasons why knowing your credit score is so important. If your score goes from good to excellent, it might be an excellent time to consider refinancing.

Rates have dropped

When the Fed raises or lowers interest rates, so do banks and credit unions. If you financed your car during a time of high rates, and then the rates drop, it’s a good time to consider refinancing. (Pssst… that’s the case right now!)

You've established enough payment history

Many of us find the car that we like and then get financing through the dealer... and those aren't always the best deals. Driving your new car home, you might pass by a community financial institution's billboard, only to realize they offer a much better interest rate.

Unfortunately, it's hard to do a return on a 4-year loan. If this is your first car, you’ll need to establish some repayment history before you consider refinancing; typically one year. If you have a longer credit history, you can consider looking at refinancing your car loan after six months.

What do you need before refinancing?

Ready to get started? Let's make sure.

Your credit score

Knowing your credit score is important to determine what refinancing offers you can expect. If your credit score has gone down, it’s unlikely that you'll find better terms than you have on your existing loan. Luckily, everyone is entitled to know their credit score for free from each of the credit bureaus.

Your car details

Financial institutions will want to know details about the vehicle you’re refinancing. Be prepared with your car’s make, model, VIN number, and mileage. The older a vehicle is, and the more miles on its odometer, the less value it holds, which means it’s less attractive as collateral for an auto lender. If you have an old car, you might have a difficult time finding an institution to refinance.

Research

If you've read this far, you're already well on your way! You know the reasons that you should refinance (or not). Now it's a question of finding the best deal for you. Like shopping for a car, you should research different financial institutions in your area. Don't just look at rates. Consider a potential lender’s services, features, and digital capabilities. Repaying the loan should be easier than taking it out.

Best of both worlds?

People refinance because they need more cash today, and because they want to get out of debt more quickly. Wouldn't it be nice if you could have both?

The Kasasa Loan® is exactly that, an auto refinancing loan in the goldilocks zone between better rates and more flexible repayment terms. The Kasasa Loan is the first and only loan to offer Take-Backs™, an innovative feature that lets you pay ahead on a loan, but access those extra funds whenever you need them.

Let’s say you refinance your existing auto loan with a new one from Kasasa® because in the year since you bought your car you got a job, have been hitting your loan payments on time, and your credit score has gradually improved. Now the end of the year rolls around and a $1,000 bonus hits your bank account (lucky you!). You know that by paying that bonus towards your auto loan, you can cut months off of your loan duration, and save a lot in interest. You’re cruising in the fast lane to debt-free — until you get a flat tire.

Life happens. You take $500 of that bonus money you paid up front and it’s right back in your bank account to pay for a new tire, thanks to Take-Backs. Doesn’t that sound like the smartest way to auto refi?

It’s a great feeling when you pay ahead on your loan debt. Especially right before your check engine light comes on.

What credit score do you need for an auto loan?

07/19/2018

If you decide to finance your next car, pay attention to your credit score, which affects the…

Read MoreHow To Get A Car Loan With Bad Credit

10/04/2018

Is it possible to get a car loan with bad credit? Here are tips to help land your new ride, while…

Read MoreShould You Ever Get A Title Loan?

10/05/2018

A title loan might seem like a great way to get quick cash, but what they won't tell you is the…

Read More