An in-depth look at how banks fared in 2020.

1. Introduction: As balance sheets have changed, so have the challenges facing community financial institutions.

2020 did not made things easy for community financial institution leaders. First COVID-19 closures, then PPP, deciding whether and how to reopen, operational challenges, not to mention static low rates. Now you're probably ready to have a better picture of how the current economy and changes in consumer behavior will influence your ability to do business. That’s why we analyzed the national data on your behalf and highlighted some noteworthy trends. We also compared how our own clients stacked up against their peers across the nation.

You can dive below the surface and see how your peers are doing.

We examined the data and sliced it into digestible layers, helping you make sense of changes in rates and consumer financial behavior in 2020. Why would we invest resources in a project like this and offer it for free? Because Kasasa is passionate about partnering with locally owned financial institutions, who in turn help consumers and their communities. Our clients depend on us for accurate, actionable insights to help them perform so highly (although, we can’t take all the credit for their exceptional success).

Monitoring industry trends can help you make better strategic decisions.

-

These data will help you understand how the current economy and consumer behavior in 2020 affected your financial institution (FI) compared to other similar FIs.

-

-

Gaining insight from 2020 can help you plan ahead.

-

Most FIs are making important decisions without good macro-to-micro data about the industry and their business.

-

-

The comparisons address the primary financial drivers or volumes that impact the financial drivers at your FI:

-

Total deposit growth

-

Total loan growth

-

Total net revenue growth

-

Net interest margin

-

Return on average assets

-

Non-interest income as a % of total revenue

-

2. Looking at the nation’s financial institutions as a whole.

Banks are flooded with deposits

-

Deposits grew twice as fast as loans in 2020 compared to the median growth of the three years prior. The growth rates for both deposits and loans were significantly higher than the preceding three years.

-

-

This was due to consumers pulling their money out of the stock market, the stimulus package, and an overall reduction in consumer spending.

-

Total deposits for the first half of 2020 grew at 22.3%, up 6x compared to the previous three years. Loans grew at 14.9% or triple that of the previous three years. That’s a tremendous increase!

-

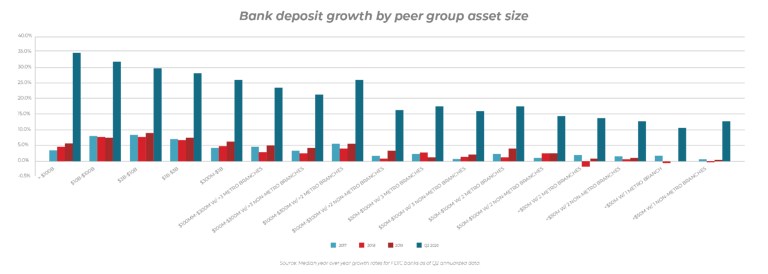

The banks with the most deposit growth were those over $100B in assets (34.5%) and those in the West (29.4%), South (23.8%), and Northeast (22.6%). Of those below $1B, $100MM-300MM banks with 2 or less metro branches saw their deposits grow by 26%— almost as much as those with more than $1B in deposits (29%).

How does your growth compare? Request your Benchmark Report.

Overall loans did grow for banks, but consumer lending is down.

Bigger banks and those in the West saw the most loan growth (27.2%), followed by the South (15.9%) and Northeast regions (14.1%).

-

Banks that were over $1B in assets saw the most loan growth. In terms of peer groups, banks in the $1B-3B range grew the most (24.9%). And banks in the $100-300MM range with 2 or less metro branches saw as much growth as much bigger $3B–10B banks (22.2%).

-

But it wasn’t just the big banks who got more loans. Smaller (less than $50MM) banks with 2 or less metro branches saw high loan growth (12.9%, up from -3.5% last year) which was better than those FIs more than twice their size and with 3 metro branches (8.1%).

-

Business lending has surged but consumer lending...not so much.

-

Most of the growth was due to PPP loans, which were responsible for 44.1% of the growth in 2020.

-

Credit cards saw the largest decline among consumer lending categories, dropping 28.3%, followed by home equity (down 10.3%).

-

Mortgage and auto loans were the only consumer portfolios to grow in 2020, and not by much (1.3% and 0.8% respectively).

-

-

-

The spike in consumer mortgage lending comes as no surprise people are taking advantage of the lowest 30-year fixed mortgage rates since 1971. Savvy consumers want to lower mortgage costs or adjust the term to keep money in their pockets or make home improvements.

-

This also correlated to recent Google search term data that shows queries for loans spiked in March 2020 and were higher than they were the year prior. For example, searches for “mortgage refi” were up 7.7X over the prior year, “auto loan refi” was 1.8X higher, and “personal loan refi” was 2X higher.

-

-

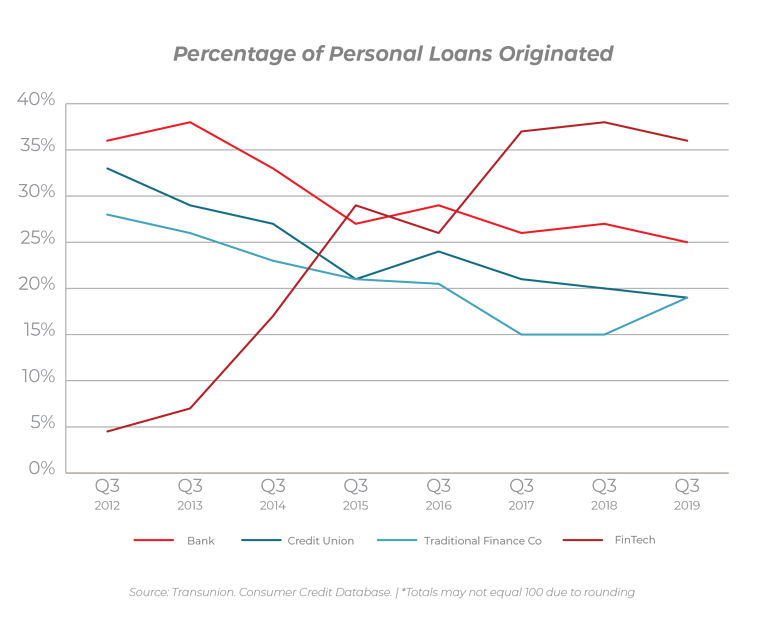

Competition for loans is getting even more heated as nonbanks continue to increase their loan origination share. Even traditional finance companies are making a comeback with their share of the personal lending market.

Overall profits are tightening for banks as interest rate margins compress due to the low-rate environment.

-

This is not a surprise given that 69% of financial executives told American Banker in August shrinking profit margins were one of their top challenges during the pandemic.

-

Return on assets is 0.98% in Q2, down from 1.09% in 2019.

-

Banks started to experience net interest margin (NIM) compression in Q1, falling to their lowest levels since 2017. NIMs are expected to continue a downward trajectory in Q3 as the pandemic fully hits bank balance sheets (3.58% in Q2, down from 3.78% in 2019).

-

Banks rely heavily on interest income

-

87% of banks’ Q2 2020 income came from interest income; and only 13% from non-interest income (NII). Smaller banks have healthier NIMs than big banks, but they can still be vulnerable to rate cuts.

-

FIs aren’t relying as heavily on fee-based income, which is back down to the level we saw in the mid-90s, after peaking right before the subprime crisis.

-

Takeaways for banks

-

While businesses were still borrowing, personal and home lending didn't keep up. But consumers are looking for financial partners to help them get competitive loan rates and manage existing debt. If you need loans, you should be targeting these types of consumers with your marketing.

-

The competition for these loans was very strong in 2020. You may not see neo-bank branches down the street, or nonbank lenders sponsoring the local high school team, but you can be certain that they’re targeting borrowers in your community.

-

There’s only so much you can do to control net interest margin based on where the Fed sets their target rate. Building a stable stream of non-interest income is a good strategy for hedging against interest margin compression, as long as it’s done in a consumer-friendly way.

3. Kasasa clients form an exceptional cohort of trend-bucking FIs

-

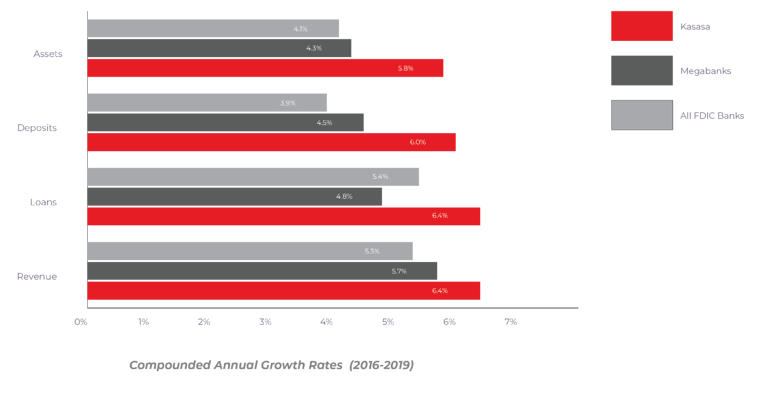

Kasasa clients are signaling strength, consistently outperforming other banks. This is likely due to a range of factors that includes partnering with Kasasa and extends far beyond our partnership. These financial institutions are executing on high-performing strategic plans that transcend asset size, location, or consumer demographics.

-

Kasasa supports FIs who seek to recapture market share from megabanks, neo-banks, and local competition. We provide innovative banking solutions that:

-

Increase younger, more profitable account holders 50% in the first year.1

-

Increase non-interest income (NII) by 45% for reward checking on average when compared to standard free checking.1

-

Help cross-sell other value-added offers that generate stable NII.

-

Help drive more loan originated balances with a loan product that 98% of consumers want to refinance their debt with if given the opportunity.2

-

-

The clients who choose Kasasa are part of an elite network of outperforming FIs.

-

They’re among the most financially fit FIs in the nation.

-

-

They have access to proven solutions to grow their account holder base and increase profitability.

How does your growth compare? Request your Benchmark Report.

1 When compared to standard free checking accounts per Kasasa Analytics 2018.

2 Based on 2017 Kasasa Consumer Study.